Repair Credit Report History

July 18, 2009 10:07 pm

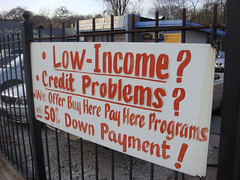

Repair Credit Report History Managing with bad credit is anyone’s worst nightmare. Once bad credit begins, it takes a lot to be able to put a stop to it and most people find themselves in over their head before they know it – with late payments and bills that are way beyond their limits. What’s more is that aside from the difficulty of eliminating your debt, bad credit ruins your credibility with other creditors and other companies that look to credit records for evaluation purposes. Therefore, once you realize that you’ve started a bad credit report, it is very important to find remedies to eliminate this and achieve fast credit report repair. The first thing you have to do is to repair credit report history. This can be done in a number of ways. One of these is to make an effort to pay your bills on time. Credit rating and reports on individuals are greatly affected by late bill payments, so make sure you pay your bills no later than 30 days after its due date. Fast credit report repair is achieved quicker if you make your payments on time – in bills, credit cards, mortgages, and other payables. Another thing you can do is to reduce the number of credit cards that you have – eliminate those that you don’t use often, and keep only about 2 to 3 reliable ones. This way, you are limiting yourself from the possibility of larger credit which you might be unable to pay. Ask you creditors to reduce the limits on your cards, as well, as these affect your credit report and will hinder your from fast credit report repair. Lenders will take into account your credit limit even if you have no debt. Avoid tax liens, bankruptcies, and collections as well. These stay on your credit report for a long time; bankruptcy can appear on your reports for as long as 10 years. Sometimes, people seek the help of bad credit repair service in order to help them in re-establishing their credit reports. While a bad credit repair service may be helpful, it is still advisable that you be wary of certain things and factors. Be wary of credit repair service companies who ask you to pay them their fees before they even get any work done. Watch out, also, if the credit repair company asks you to avoid contacting any of the three major credit card companies, or if they claim that they can clean up you r credit report history, even if your record has current and accurate information. If you’re looking to repair credit report history, there are lots of ways that you can clean up your act. With a little control and effort, you’ll be well on your way to a clean credit report. Research, evaluate your situation, and study the steps you can take and make your fast credit report repair a reality. And if you find that you are intimidated or overwhelmed by the process, feel free to give DebtBusters911 a call! Tariq Ghazi is a devoted writer.